Stamp duty abolished for first home buyers – but we’re not celebrating

The long awaited abolishment of stamp duty has just passed Parliament and while many first home buyers may be popping the cork right now, we’re taking a not so pleasant trip down memory lane and remembering the last government first home buyer incentive scheme in 2008-2009.

The Federal Government has announced that stamp duty for first home buyers (FHB’s) will be abolished on properties valued up to $600,000. A reduced concession will be available for those buying a home between $600,000 and $750,000. Sounds great, right? So what happened back in 08-09 that’s causing us to hold off on celebrating now?

Following the onset of the GFC during 2008, a large government stimulus was initiated. Among other things (let’s not forget Ruddy’s $950 “everyone head to the shops” payment) one of the incentives was a First Home Owner ‘Boost’ giving first home buyers a $14,000 payment for purchasing their first established home.

As a result, FHB activity surged. All of a sudden, a large number of first home buyers entered the market earlier than they would otherwise have done. Sellers of properties in the FHB price bracket (back then $300,000 to $400,000) who were initially not selling all of a sudden saw an opportunity and wacked a For Sale sign up and watched the first home buyers come in droves.

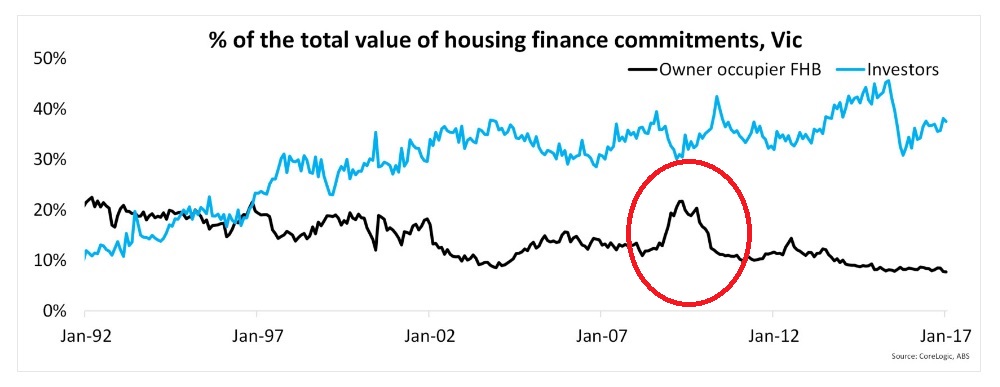

The peak occurred during the year to November 2009, with about 190,000 FHB mortgages being issued to owner occupiers. The FHB share of the owner occupier market peaked at 29 per cent during this period (see below highlighted).

And the result? An inflated property market in the FHB price bracket as the demand outweighed the supply. Melbourne’s median house price soared by 30% from the beginning of 2009 to the middle of 2010 as a result of this activity. We sure hope history is not going to repeat itself.

If you’re a first home buyer preparing to enter the market, brace yourself for the competition. Do your research on what a property is actually worth before you buy (we can help with property guides). Stick to your budget and know your figures before you attend – you’ll need to make some changes to them now that stamp duty is out of the picture. Don’t get put off by the masses at an auction.

Most of all, it’s important to not get swept up in the hype and over extend yourself. We are in a period of historically low interest rates, be certain that you can afford the repayments on a loan not only now but if rates increase in the future also.

Contact us now for a comprehensive finance overview on what this means for you including your new maximum purchase price.